![ferrari 599 GTB Fiorano]()

This morning the U.S. Department of Justice announced criminal charges against three former ICAP brokers in the Libor manipulation case.

The ex-ICAP employees named DOJ's complaint are Darrell Read, who lives in New Zealand, and Daniel Wilkinson and Colin Goodman (a.k.a. "Lord Libor"). Wilkinson and Goodman are from England.

The former ICAP brokers (two derivatives brokers and one cash broker) are accused of conspiring together with a senior trader from UBS to manipulate Yen Libor, according to the DoJ.

Aside from facing criminal felony charges, the former ICAP brokers had their Instant Messages, text messages and e-mails from 2006 to 2011 made public by the U.S. Commodity Futures Trading Commission.

We've included some of the more cringeworthy ones below:

According to the CFTC, the following exchanges show how the ICAP brokers skewed Libor for the UBS senior Yen trader.

October 23, 2006:

Derivatives Broker 1: Morning Lad [Cash Broker 1], On the scrounge again, if possible keep 3m the same and get 6mos as high as you can. My guy has an enormous fix on Wednesday in 6mos and will want it as high as possible. Waiting for my credit card to get returned to me from a drunken night out bowling, but will be supplying you with copious amounts of curry on it's imminent return. Cheers

December 7, 2007 :

Derivatives Broker 1: Hi [Cash Broker 1], Thanks again for all your efforts, … Can you do your best to drive these libors higher,especially 3 mos if you can and it is still well bid....UBS had to stagger their move up but will definitely be in the count today. … p.s Bubbly on its way with [Senior Yen Trader].

February 29, 2008 (via text message to personal mobile phone)

Derivatives Broker 1: If u can pls move 3m up more than 6m wud be much appreciated :-P

Cash Broker 1: What happens if they go down. 3m looked higher yesterday pm and 6m no change

Derivatives Broker 1: Make 6m go lower! They r going up. [Senior Yen Trader] will buy you a ferrari next yr if you move 3m up and no change 6m

Cash Broker 1: Not bad isuppose 9625 against 01625

The CFTC says that these messages show how the ICAP brokers bonuses would be impacted by their "Libor services."

April 18, 2007

Cash Broker 1: Hi [Yen Desk Head] with ubs how much does he appreciate the yen libor scoop? It seems to me that he has all his glory etc and u guys get his support in other things. I get the drib and drabs. Life is tough enough over here without having to double guess the libors every morning and get zipper-de-do-da. How about some form of performance bonus per quarter from your b bonus pool to me for the libor service ***

Yen Desk Head: Lord Baliff, I would suggest a lunch over golden week.Monday or Tuesday if you are around. *** As for kick backs etc we can discuss that at lunch and I will speak to [Senior Yen Trader] about it next time he comes up for a chat.

In this message, one of the brokers talks about how they're 'managing to fudge' the Libor rates for the Yen trader.

January 10, 2009

Derivatives Broker 1: [to Derivatives Broker 2] I hope [Senior Yen Trader] is not being too painful, he has had a storming start and is very happy with the libors [Cash Broker 1] and yourselves re managing to fudge for him (as long as he thinks you are trying!).

The brokers also talk about other banks will be "making fortunes" with "high fixings."

August 23, 2007

Derivatives Broker 1: [Derivatives Broker 3] does [RBS Yen LIBOR Back-Up Submitter] have any influence over their libor sets . . . if he does ask him to do us a favour and edge 6m up please.....think [Bank E Yen Trader] was chasing [Cash Broker 1] for a high fix as well ,so should do us all a favour. . . thanks

Derivatives Broker 3: [RBS Yen LIBOR Back-Up Submitter] is doing them this wek , he wants 6's up so will be marking them up anyway

Derivatives Broker 1:brooliant!! they are making fortunes with these high fixings!!! :-) thats UBS,RBS and[Bank E] + M’Lord should be ok!!

The CFTC says this IM exchange shows how the brokers continued to help the Yen trader. There's also a mention of buying a steak dinner in here.

March 3, 2010:

1st message:

Senior Yen Trader: i really need a low 3m jpy libor into the imm any favours you can get with the due at rbs would be much appreciated even if he on;ly move 3m down 1bp from 25 to 24

Sterling Broker: i'll give him a nudge later, see what he can do

Senior Yen Trader: thanks mate really really would appreciate that

Sterling Broker: haven't seen him since i left so might buy him a steak to catch up

Senior Yen Trader: yeah … i have a huge fix on the imm so if he moves down 1bp now and leaves it that would be great

2nd message:

Sterling Broker: can i pick ur brain?

RBS Yen Submitter: yeah

Sterling Broker: u see 3m jpy libor going anywhere btween now and imm?

RBS Yen Submitter: looks fairly static to be honest , poss more pressure on upside , but not alot

Sterling Broker: oh we hve a mutual friend who’d love to see it go down, no chance at all?

RBS Yen Submitter:haha [Senior Yen Trader¬¬¬] by chance

Sterling Broker: shhh

RBS Yen Submitter: hehehe , mine should remain flat , always suits me if anything to go lower as i rcve funds

Sterling Broker: gotcha, thanks, and, if u cud see ur way to a small drop there might be a steak in it forya, haha

RBS Yen Submitter: noted ;-)

Sterling Broker: 8-)

3rd message sent the following day:

RBS Yen LIBOR Submitter: Libor lower ;-)

The U.K.'s Financial Conduct Authority fined the London-based brokerage house £14 million, or $22.4 million, in the Libor case. The U.S. Commodity Futures Trading slapped ICAP with a $65 million civil penalty.

SEE ALSO: 23 Cringeworthy Quotes Wall Streeters Probably Wish Were Never Public

Join the conversation about this story »

On September 16th and 17th hundreds of investors will get together in

On September 16th and 17th hundreds of investors will get together in

After the opening remarks, Kinder goes into a 20-minute or so discussion. That part was relatively calm.

After the opening remarks, Kinder goes into a 20-minute or so discussion. That part was relatively calm.

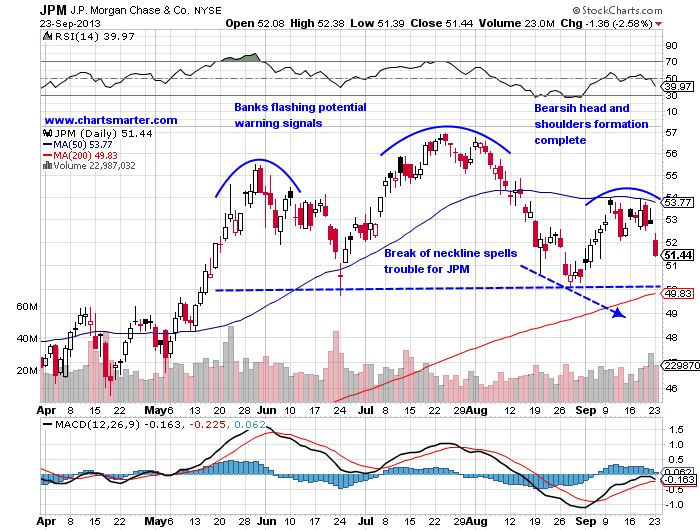

Is the headline risk finally catching up with JPMorgan? The relentless barrage of legal problems hasn't hurt the company's business one whit so far from outward appearances, but might it be affecting the stock price?

Is the headline risk finally catching up with JPMorgan? The relentless barrage of legal problems hasn't hurt the company's business one whit so far from outward appearances, but might it be affecting the stock price?